First paycheck calculator

For final bonuses or commissions final payments must be made on the first regular payday after the amount is calculated. Pay frequency File status.

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

. When you received your first paycheck from your first job it may have been considerably lower than you were expecting based on the salary you. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. The interest rate does not change for the first five years of the loan.

Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. In 2019 the federal unemployment tax rate is 6 on the first 7000 of each employees wages each year.

Overview of New Jersey Taxes. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data. Sigourney Weaver on her unpredictable career With more than 60 film credits including four movies debuting this fall Sigourney Weaver seems to have found her place and at her own steady pace.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The first deduction that all taxpayers face is FICA taxes self-employment tax.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Now you can easily create a Form W-4 that reflects your planned tax withholding amount. StRAWberry SHortcAKE 460 Alone with her new brothers Maria gets her first taste.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. How You Can Affect Your Arkansas Paycheck. There are 4 main filing statuses.

So if Person A has a base salary of 30000 per year but could make up to an extra 70000 per year in commissions start with the 30000 to ensure that you at least cover the monthly joint expenses. Automatic deductions and filings direct deposits W-2s and 1099s. Paycheck Calculator ADDALLOW CAT DCA1 DCA2 DCA3 DCA4 DCA5 DCA6 DED1 DED3 DED4 EPMC EPMC_ EPMC2.

Note that the default rates are based on the 2022 federal withholding tables IRS Publication 15-T 2022 Percentage Method Tables pg 10 but you can select prior years. There are certain deductions like federal income and FICA taxes taken from your paycheck no matter which state you call home. Overview of New Mexico Taxes.

Your job income salary year. The rates which vary depending on income level and filing status range from 140 to 10. Overview of Kansas Taxes.

Nebraska like most states also deducts money to pay state income taxes. Additionally no Florida cities charge a local income tax. Overview of Georgia Taxes.

For the first time ever young Maria was left alone with. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Exempt means the employee does not receive overtime pay.

Your employer will also withhold federal income taxes from your. Youll get a pleasant surprise when you see your first paycheck. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

If your monthly paycheck is 6000 372 goes to Social. Step 1 Filing status. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

If the full amount of the retirement exclusion was not applied to the first half payment you should not when an employee will not receive pay in the 1st half enter 1 in B6 to allow the retirement exclusion eg. After that time period however it. Then enter the employees gross salary amount.

The Garden State has a progressive income tax system. Our paycheck calculator at the top of this page includes state-specific data but if you want to get more details about the numbers that go into our tax calculations choose. Gross wages for hourly employees.

Get breaking Finance news and the latest business articles from AOL. Register to save paychecks and manage payroll the first 3 months are free. Peach State residents who make more money can.

The tax rates. These calculators are not intended to provide tax or legal advice and do not represent any ADP. Use our free mortgage calculator to easily estimate your monthly payment.

A financial advisor in Arkansas can help you understand how taxes fit into your overall financial goals. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Federal state liability or refunds.

Simply select your state and the calculator will fill in your state rate for you. See which type of mortgage is right for you and how much house you can afford. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. First youll want to do a baseline calculation. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987.

It is not a substitute for the advice of an accountant or other tax professional. Touchy Feely 467 Not even a box of rocks should be taken for granite. New Mexico has a progressive income tax system with four brackets that are each dependent on income level and filing status.

Why Gusto Payroll and more Payroll. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. That means the only taxes youll see.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Why Gusto Payroll and more Payroll. The primary difference between payroll for hourly and salaried employees is how you calculate those gross wages in the first place.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. First you need to determine your filing status to understand your tax bracket. Plus the paycheck tax calculator includes a built-in state income tax withholding table.

Arkansas residents can tweak their paychecks in a few ways. From stock market news to jobs and real estate it can all be found here. 2021 2022 Paycheck and W-4 Check Calculator.

- 513 to apply appropriately. Exhibitionist Voyeur 020520. This is where you put in the worst-case scenario gross income for the individuals.

From Paycheck to Purpose Book Get Clear Career Assessment See All Products. Exhibitionist Voyeur 021720. Use this paycheck calculator to figure out your take-home pay as an hourly employee in North Carolina.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Important note on the salary paycheck calculator.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Paycheck Calculator Hourly Salary Usa Dremployee

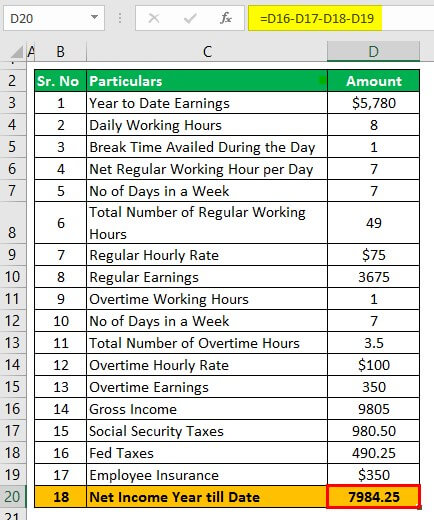

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

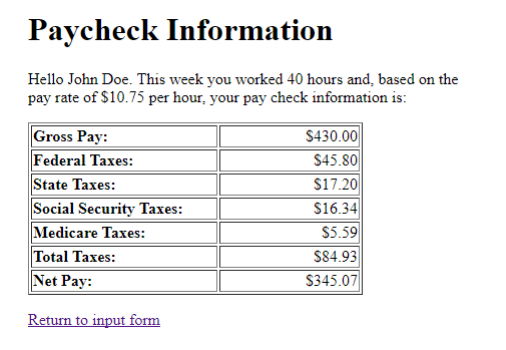

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator Take Home Pay Calculator

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Rhode Island Paycheck Calculator Smartasset

Solved Paycheck Calculator In This Assignment You Need To Chegg Com